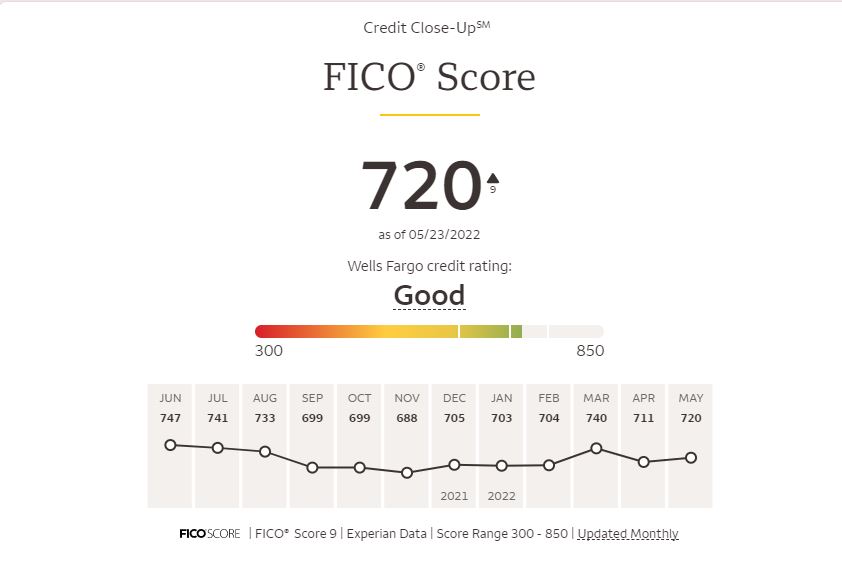

Not all credit scores are FICO Scores. For over 25 years, FICO Scores have been the industry standard for determining credit risk. More than 90% of lenders use FICO to make faster and more accurate lending decisions. Non FICO scores can be off by as many as 100 points. Buyer beware!

So what exactly is the difference between FICO scores and imposter scores?

90% of reputable lenders base their decisions on FICO Scores when determining credit approval, conditions, and interest rates. It’s likely that the bank or lender will check your FICO Score when you apply for a mortgage, an auto loan, a credit card, or a new line of credit.

The reason? When lenders examine a FICO Score, they are aware of what they are getting. FICO Scores are regarded as an accurate and trustworthy indicator of a borrower’s propensity to make timely loan payments. Lenders assume less risk when FICO Scores are routinely used, and you have quicker and more equitable access to the credit you require and can handle.

Based on the data in your credit reports, FICO Scores employ special algorithms to estimate your credit risk. The mathematical formulae that other organizations use can differ substantially, even though many other businesses design their credit ratings to resemble a FICO Score.

Sadly, these other organizations’ methodologies may produce credit ratings that are significantly different from your FICO Score. Additionally, a difference of even a few percentage points can have a substantial impact on your terms and rates, potentially costing you hundreds or even thousands of dollars.

Why Does It Matters That Your Score is FICO?

Imagine a world where each potential lender had their own unique process for determining whether or not to grant you a loan. You wouldn’t be able to tell if you would be accepted somewhere and rejected somewhere else.

In fact, this was the situation not too long ago. Lenders would decide whether or not to offer credit in a variety of ways (including, among other things, using information about a person’s address, type of employment, and gender). People were frequently accepted or rejected based on contradictory and perhaps unfair information

The FICO Score were developed in 1989 to assist lenders make decisions more quickly and to make the loan process more fair and uniform for borrowers like you.

Top Reasons to Chose FICO over FAKO Scores

- You can be sure that the score you are viewing is one that many lenders actually utilize. The likelihood that the lender will examine your FICO Scores when you apply for credit is very high because they are the most commonly used scores.

- You’ll be able to make wiser financial choices. Because you can see the scores that 90% of the top lenders use, FICO Scores give you more information on when to apply for credit.

- You receive a score that changes over 25 years to fit your needs. Since the introduction of the FICO Score, a lot has changed in how we use credit. For instance, in order to keep up with escalating expenditures, we now use credit cards more frequently and take out larger loans.

Keep in mind that non-FICO credit ratings might vary by up to 100 points. Your FICO Score may differ from other credit scores by several points. This variation can lead you to overestimate your chances of being accepted. A recent Consumers Union research claims that “Consumers who have score disparities may believe they are eligible for loans or reduced interest rates when they are not. Consumers may experience unexpectedly high interest rates or be denied credit.”

However, non-FICO credit scores may cause you to undervalue your creditworthiness, preventing you from getting a much-needed family car or refinancing a mortgage that may save you thousands of dollars in interest.

The FICO Score have altered as consumer spending patterns have changed. For instance, FICO Scores continue to correctly anticipate credit risk, allowing you to access the credit you require and obtain manageable credit. You gain decades of knowledge and skills that are leading in the industry and that lenders value and trust when you use FICO Scores.

FICO Scores vs. FAKO Scores

| FICO Scores | Other Credit Scores |

|---|---|

| The standard for over 25 years, used in over 90% of lending decisions | Often called “educational” scores or FAKO |

| Makes lending decisions consistent, fast, and fair | Can be significantly different than your FICO Scores |

| Gives you a better understanding of your credit and more confidence when you apply | Can be off by up to 100 points —causing you to under or overestimate your creditworthiness |

It needs to say FICO to be considered a FICO score.

A FICO score is simply incomparable. Remember that there was no industry standard to ensure that credit access was more accurate and fair before to the development of the FICO Score. It only makes sense to obtain the credit ratings that your lenders will use when you want to know how your credit stands.

A word of warning: unscrupulous websites may attempt to sell credit scores under the guise of FICO Scores. It’s probably not a FICO Score if it doesn’t expressly state that it is.

Further Reading:

- The Ultimate Guide to Credit Repair for 2022

- The Best Credit Repair in Dayton for 2022

- Using Mint in Credit Repair for Better Results

- Credit Repair During the COVID Crisis

- Use of Credit Repair Sample Letters

- How to Check Your Credit Score

- Why are Credit Scores Hard to Understand?

- Easy Credit Score Hacks for 2022

This article was last updated on August 31, 2022