Your credit score can be viewed in a variety of ways, and there are numerous scoring agencies. As such, you may ask how to check you credit score. The FICO score and VantageScore are the two most well-known credit scores that you’ve probably heard about. Numerous reputable sources, including some credit card lenders, authorized online sites, and governmental organizations, offer free access to your credit score.

Your credit score has a significant impact on your financial situation. It applies to situations where a lender is required, such as when applying for loans like credit cards, mortgages, and vehicle loans. You may put yourself in a position for financial success by being aware of your score, whether it is high, low, or average. Below, we’ll go through crucial details to be aware of before checking your credit score.

Reminder, if you are looking for credit repair please check our Ultimate Guide to Credit Repair, updated for 2022!

What Goes Into Your Credit Score?

The straightforward formula that makes up the FICO credit score computation process has five components. These components include:

- Payment History (35%):

- Credit Utilization (30%):

- Credit Age (15%):

- Credit Diversity (10%):

- Application History (10%):

Both your FICO score and your VantageScore are mostly influenced by your payment history and credit utilization. According to VantageScore, they evaluate your likelihood of timely loan payback by comparing “your behavior with that of other borrowers.” Depending on the reporting agency you choose, your score may change by a few points since while their systems are similar, they place a different emphasis on particular factors..

What Is the Best Way to Check Credit Scores?

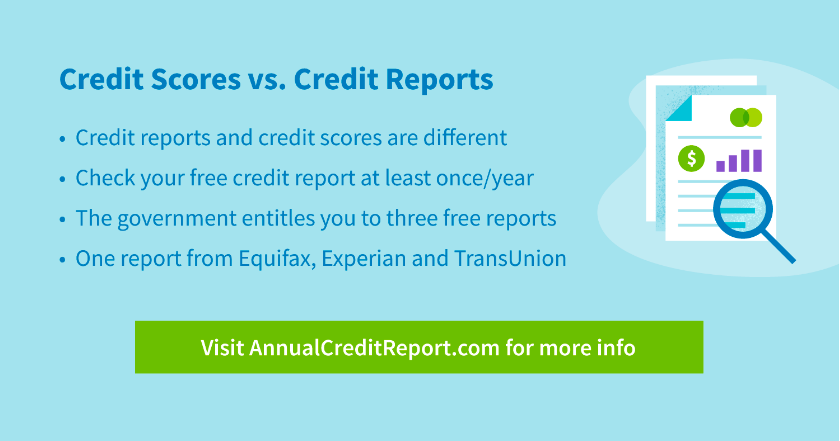

You should first be aware that your credit report and credit score are two distinct things. A credit report is a thorough summary that includes information on actions like account opening. Simply put, your credit score is a three-digit summarization of your credit history.

When you check your credit report and score, make sure you’re doing so safely.

Know What the Government Guarantees

“You are entitled to a free credit report from each of the three credit reporting companies (Equifax, Experian, and TransUnion) once every 12 months,” the US government guarantees. They also say that the three free guaranteed reports can be spread out over the course of the year, albeit at the moment you can acquire a free copy of your credit report every week until April 2021 as a result of the financial disruption brought on by the Coronavirus (COVID-19) epidemic. To request your report and learn more, go to AnnualCreditReport.com.

If you’re denied a free credit report that you rightfully deserve, try to resolve the issue with the credit reporting agency. If that doesn’t work, reach out to the Consumer Financial Protection Bureau (CFPB).

Check Your Credit Report at Least Once a Year

As mentioned above, you’re entitled to free reports from those reporting agencies. So, at the very minimum, you should be checking those out once per year. You might want to check your score more often if you:

- Plan on applying for a home loan or an auto loan

- Suspect that you’ve been affected by identity theft

- Are searching for a job, as many employers will check your credit report before hiring you

There are options if you’d like to dispute your credit report.

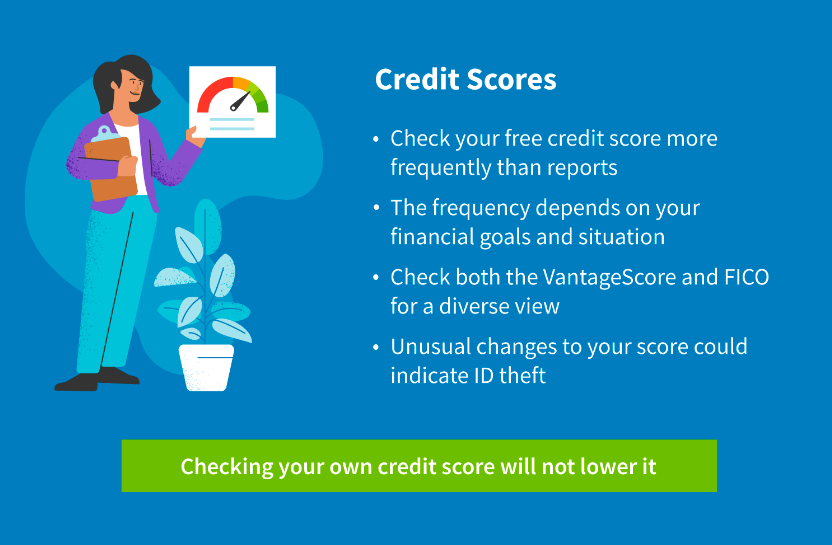

Does It Hurt My Credit to Check My Credit Score?

It’s considered a “soft inquiry” and has no effect on your credit score when you check your own credit score. When a lender checks your score, it’s typically a “hard inquiry,” which could cost you a few points. This is one of the reasons that monitoring your credit will not have a negative effect but applying for a lot of different credit cards will.

Which Type of Credit Score Do I Check?

Some professionals advise routinely reviewing both your VantageScore and FICO score. This enables you to view what potential lenders will see and gain a better knowledge of the complete range of your credit score. Since VantageScores and FICO scores evaluate credit using very similar criteria, it doesn’t hurt to look at other free reports to gain an alternative perspective. (Read the terms and conditions of any free credit score reporting service carefully before registering; you can never be too cau

How to Get a Free Credit Score Report

There are many free sources available to check your credit score, including government-run counseling, free websites, and your credit card company. You may need to have various papers or pieces of information on hand, depending on the procedure, in order to obtain your score report, such as:

- Name

- Address

- Date of birth

- Social Security Number (SSN)

Please be cautious of websites that offer fake credit scores or reports. To prevent identity theft, only submit important information on websites that have been validated. Choose from the options below to get a free credit score report that best meets your needs.

Free Online Score Reports

Equifax, Experian, and TransUnion are the three main credit reporting agencies. As previously stated, you will receive one free credit report from each of these organizations each year (currently one per week through April 2021). For those who join up with Discover, free FICO credit ratings are also available (not just Discover cardholders). Other well-known businesses that provide you access to your credit score include:

- Credit.com (VantageScore from Experian)

- Experian (FICO score)

- Wallethub (VantageScore from TransUnion)

Credit Card Lenders

Verify with your credit card provider because many banks and credit unions will provide you free access to your VantageScore or FICO score. While some lenders only offer this option upon your request, others do it automatically. Several well-known lenders offer free credit score reports, including:

- American Express (FICO score)

- Bank of America (FICO score from TransUnion)

- Barclays (FICO score)

- Capital One (VantageScore)

- Chase (VantageScore from TransUnion)

- Citi (FICO score)

- Commerce Bank (FICO score)

- Discover (FICO score)

- First National Bank (FICO score)

- First National BankUSAA Bank (VantageScore)

- US Bank (FICO score from Experian)

- Wells Fargo (FICO score)

Government Entities

For those who desire more details regarding their credit score, there are choices that are financed by the federal government. A counselor at the National Foundation for Credit Counseling can help you..

As you can see, there are several options for checking your score and obtaining more information about your credit and financial situation. There are actions you may take to raise your credit score if you’re not happy with it. In order to assist you dispute unjustified bad points and achieve your financial objectives, a credit repair evaluation will evaluate these many components of your credit score.

Learn how to repair, enhance, or develop your credit. Learn more about the fundamentals of credit, the factors that determine your score, and the effects that credit can have on your life.

This article was last updated on August 31, 2022