As long as FICO scores have been in existence, folks have been trying to reverse engineer the various scoring models. There are rules of thumb when determining how credit card utilization impacts a FICO score. Take time to learn the ins and outs of credit scoring.

It’s the percentage, stupid!

Everyone knows that your credit card utilization impacts your credit score. It is common knowledge that 30% of your FICO score is related to utilization. How it breaks down from that point is a little more unclear.

Think of your score as having buckets. There are five major buckets including payment history, utilization, age of accounts, inquires and mix of credit. Utilization counts for roughly 30 percent of your overall credit score makeup and is the second largest bucket.

Utilization is essentially your amount of credit card balance divided by your total credit card limit. It is that simple!

Credit Card Utilization – A Primer

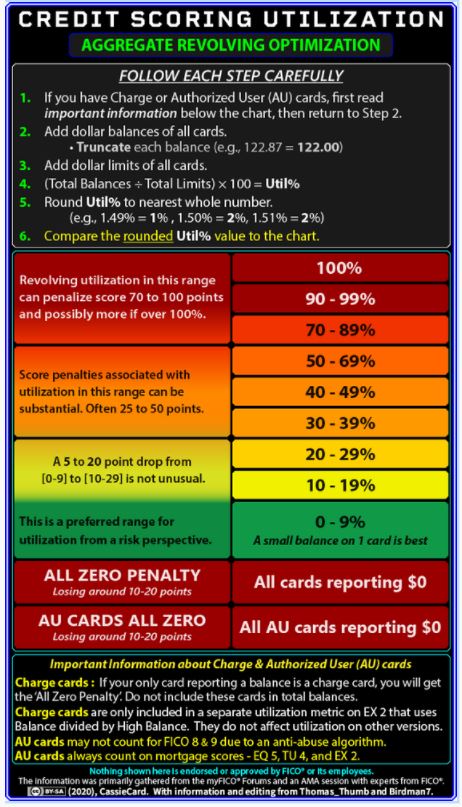

Fundamentally, the lower your utilization the better your score will be. There are a number of caveats that can be shared and dissected, but that is utilization scoring at it’s most basic. If you have a clean, fairly thick file you can expect the following on basically all FICO models:

- 100%-70% Utilization: This will usually count against your score anywhere from 70 to 100 points.

- 69%-30% Utilization: This will usually count against your score anywhere from 25 to 50 points.

- 29% to 10% Utilization: This will usually count against your score anywhere from 5 to 25 points

- 9% to 1% Utilization: This is ideal for credit scoring.

The lower the amount of usage you show, the better your credit score will be. It isn’t tricky but it does take discipline.

No Utilization? Minor Problem!

FICO scoring does not like to see no revolving credit being used. If your current report is showing no balance on any card, you will actually see about a 15 point drop. The logic is simple. If you are not showing any credit use, it is harder for the scoring formula to assess a risk so it will hedge a little bit.

Credit scoring has changed slightly over the past 20 years, but it is fundamentally the same. Certain score variations will put more weight on specific elements depending on what you are looking to accomplish.

This article was last updated on May 9, 2022