Credit scoring is a difficult system to understand. How come one credit card provider shows one score yet another shows something entirely different? Does that matter? Why are credit scores hard to understand? In this article we will look at one consumers snapshot to showcase why it is confusing, and what you can do to be best prepared.

The Reason Credit Scores are Hard to Understand

When credit scores were designed, they were not designed with the consumer in mind. The main reason credit scores exist is to help lenders make snap decisions on whether or not you are credit worthy. Credit scores are not very transparent, and their formulas are trade secrets. While many consumers and publishers have reversed engineered this to a degree, it is still extremely hard to follow all the twists and turns.

Credit scoring providers have given high level explanations on what moves a score, so consumers can be more astute on how they use their credit. Another important reason these are hard to understand lies in the fact there are literally hundreds of different scoring models. FICO has over 40 versions of their score that is available for purchase by lenders and consumers alike. This does not include all the non-FICO scores such as Vantage.

One Consumers Score Snapshot in May 2022

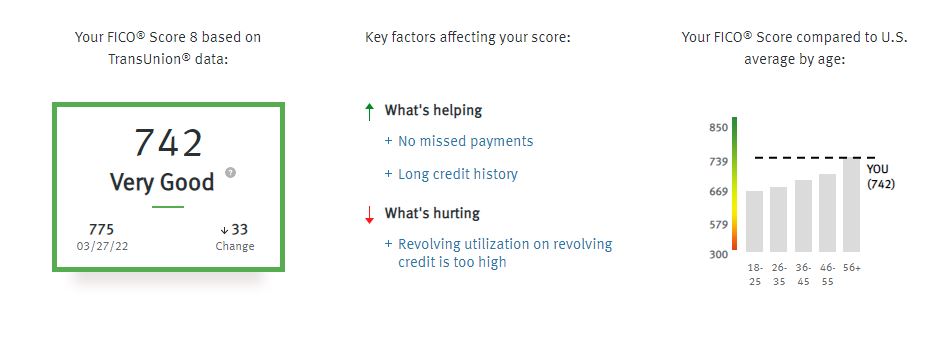

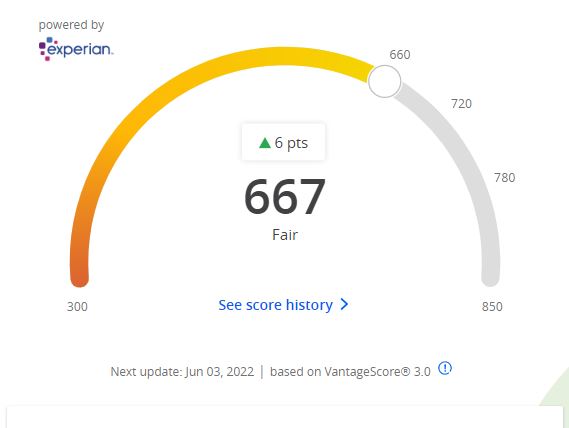

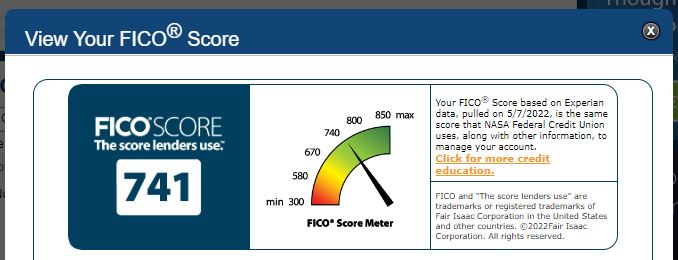

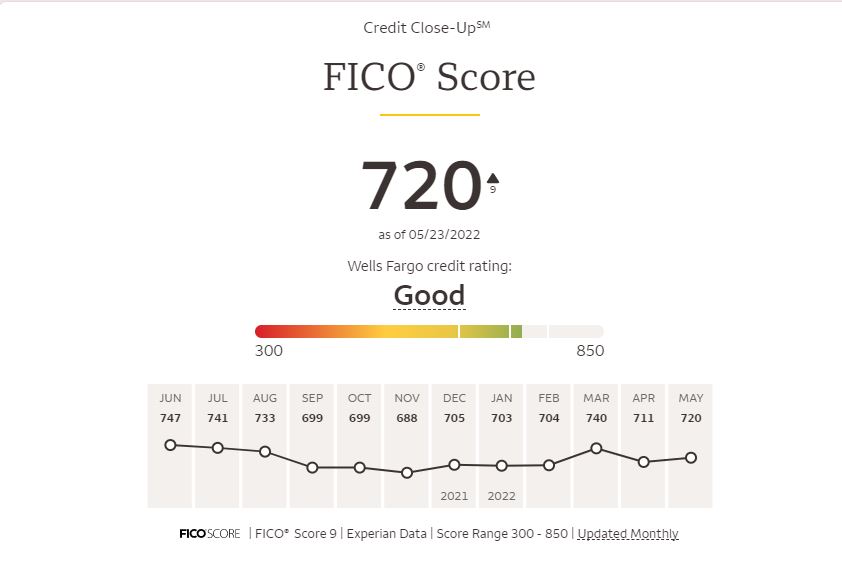

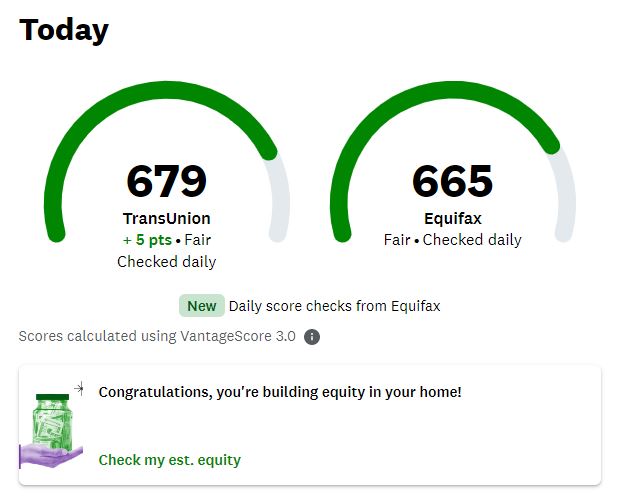

The following images are the varying types of scores that one consumer had during May 2022. This is a visual showcase on why it is hard to know exactly where you stand with your score. The bulk of these are Vantages scores, with some FICO thrown in as well. This consumer has a good credit profile with many credit card options to view their score.

With a low of 667 and a high of 742, it will be hard for this consumer to determine what would be the score being used in their purchase or their lending application. Here are some quick pointers to help you understand your credit score.

Vantage Scores are Worthless

Sorry credit bureaus. Your credit score is worthless. The Vantage score is used by so few lenders, it is hard to say it has any value at all. If you are relying on your Credit Karma scores, don’t. Credit Karma scores are Vantage. In fact, I will go as far as saying if you see the word Vantage associated with any score you should discard it. Credit Karma, NerdWallet, WalletHub, Capital One and Chase ALL use Vantage scores with their products, but NONE of them use this score in any financial considerations. These scores can vary wildly from your FICO score.

Most Lenders Use FICO but Which One?

This is a question that can be difficult to answer. Resources at the MyFICO forum provide some clue, but you really need to piece it together. There are ways you can do so for free, or paid through MyFICO’s paid services.

- Try to get at least one FICO score from each credit bureau’s data. For this consumer, The NASA provides an Equifax data FICO 8, The Discover Card provides Transunion FICO 8, and the Wells Fargo provides Experian FICO 8. This is a pretty respectable free snapshot of where their credit is in this moment. While they aren’t mortgage scores, they will be similar and close.

- Purchase your entire FICO landscape at MyFICO. I would only recommend this if a purchase is imminent, such as a car or home. This will give you every possible combo of FICO score, from Auto-Enhanced to the 3 bureau lender pull your bank will use for mortgages.

Scores are Only Snapshots in Time and Have No Memory

This is an overlooked part of credit scoring. A credit score is a snapshot in time, calculated with data that is currently showing on your credit report. The score is designed as a predictor of future financial default, not a reward for past behavior although it is often presented that way. If you remove a negative item, for example. your score could improve dramatically overnight. The score is run in the moment the data is pulled.

Having the most current credit score in your hands will be most impactful for purchases. Having a 753 credit score in February could already be worthless to you in May, if data change which is most certainly will have.

Credit Score Shop with Research

Often when rebuilding, one score will be dramatically better than others. For example., you FICO scores for Transunion are consistently in the 700s because a collection account is not showing on that credit report, but is showing on the other two. Those scores are in the low-600s. If you are doing a lower level purchase like an auto loan, or applying for credit, they will often only pull one credit bureau. Research the lenders that pull exclusively from you best score and credit report, and apply there. You will have much better luck re-establishing your credit.

This article was last updated on May 28, 2022