During and post pandemic, there has been an escalation in the amount of identity theft. With stimulus checks, unmonitored mailboxes and higher than normal unemployment, criminals have waged war on the average consumer. If you are a victim, however, there are fantastic resources than can help you. This is my Ultimate Guide to Identity Theft Repair for 2022.

Ultimate Guide to Identity Theft Repair for 2022

While not your fault, you will still need to do plenty of legwork to repair your credit post identity theft. Getting familiar with the tools needed is important. If you have not done so, you will need to pull your credit reports from AnnualCreditReport.com. This website is maintained jointly by all three credit bureaus. Just follow step by step instructions on how to get your free report from each company. You will need to provide some sensitive information, so make sure you are logging in from a trusted internet source, as opposed to public WI-FI. Due to the CARES act, this is available weekly until December 2022.

What To Do Immediately After Discovering Identity Theft.

Discovering your identity is compromised is unpleasant, but there are steps you can and should take to protect yourself. Take a look at your credit report, and take note of any account you believe fraud has taken place. Additionally, you should log into every credit card account or bank account you have and check ALL recent activity to have a firm understanding of accounts that have been compromised.

- Call the companies in which you know fraud has occurred. You will need to speak with the fraud department. Be prepared for the closure of those accounts. Additionally, you may ask for a freeze, however it is recommend to close any compromised accounts. Make sure you get the name or identifying number of who you spoke with. You will need this information when you file your FTC Identity Theft report.

- Place a fraud alert on your credit files. I don’t say this lightly. Anyone that has followed my credit repair post or has read my book knows I am not a big fan of fraud alerts in general, because it makes it far more difficult to repair things. However, this is real fraud, and you need to act quickly. You can do this online, but it is quicker to call the all three credit bureaus. To be clear, this is NOT an extended fraud alert.

- File an Identity Theft report to the FTC, via IdentityTheft.gov. We will go over this in the next segment. You still may want to file a police report with your local police department, but the report you generate through the FTC is a LEGALLY BINDING report, and will be all you need to facilitate any removals or corrections from lenders or the three credit bureaus.

At this stage, take a breath. The wheels are now in motion and at this stage you are starting to regain control of your situation.

How to File an IdentityTheft.Gov Report.

Filing an Identity Theft report is quite easy, and can be done in a manner of minutes. It will be helpful for you to have all the information that you gathered in your first step handy at this time, as you will need to report as MUCH as you know about what has occurred.

The very first step is to navigate to the IdentityTheft.gov website, and click on File a Report of ID Theft.

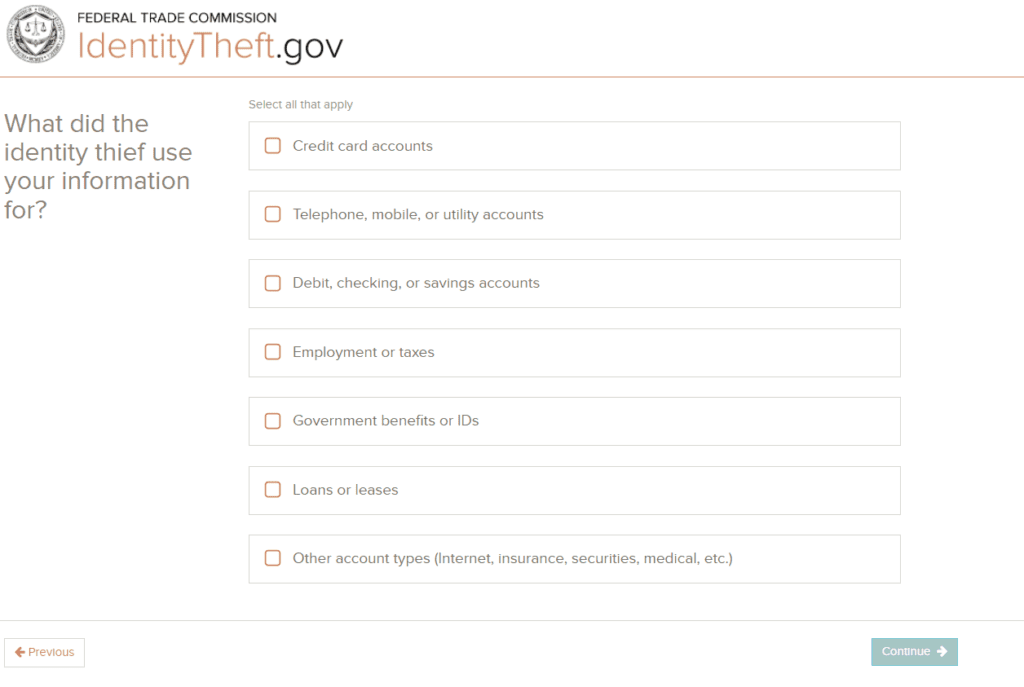

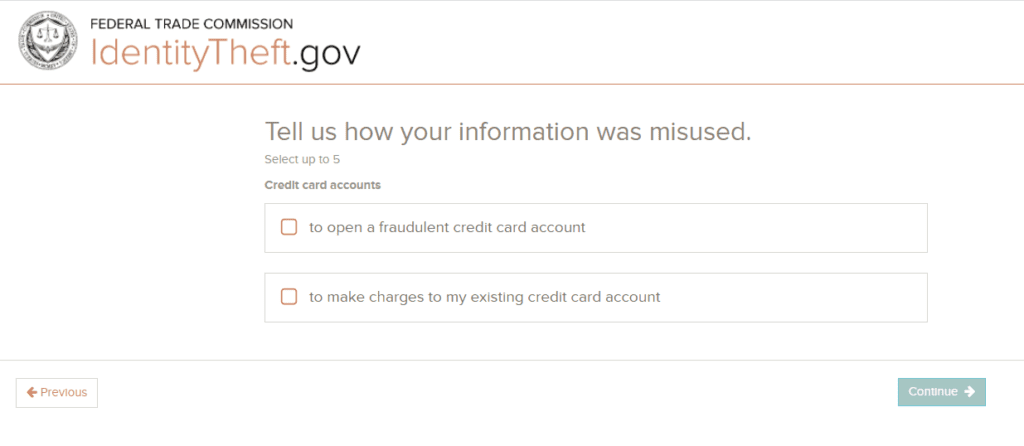

That link will take you a wizard that will let you select the type of compromised accounts. Please only select the ones you suspect have been compromised. After you select the types of accounts, it will then ask you what occurred. Be as specific as possible.

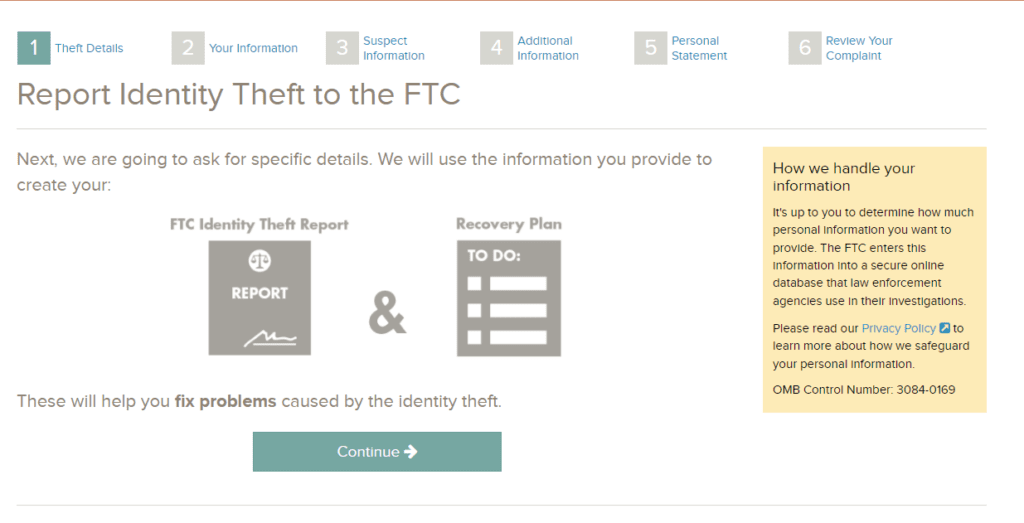

This will confirm you are eligible to begin the process, and begin we shall!

Identity Theft Repair: Filing the FTC Identity Theft Report

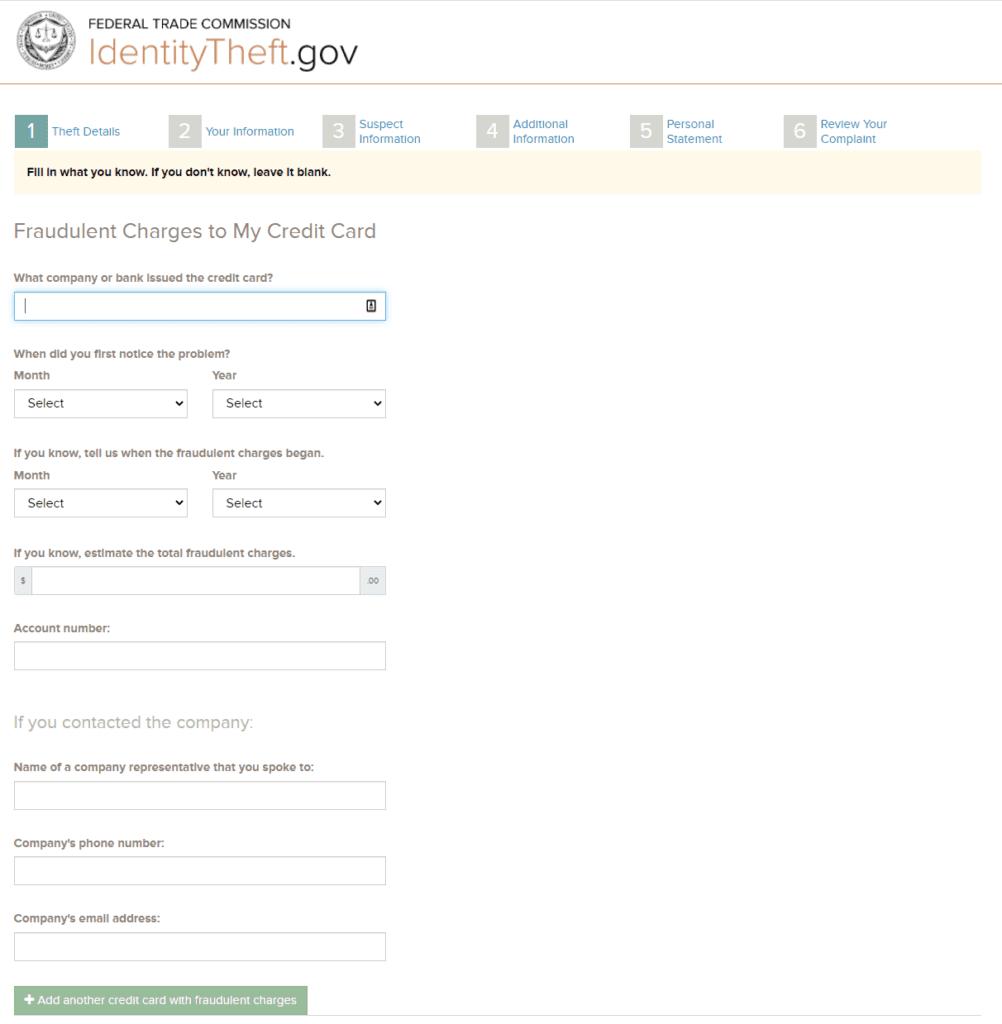

You will now enter information about each account that has been compromised, in succession. Follow the prompts to make sure you do not miss anything.

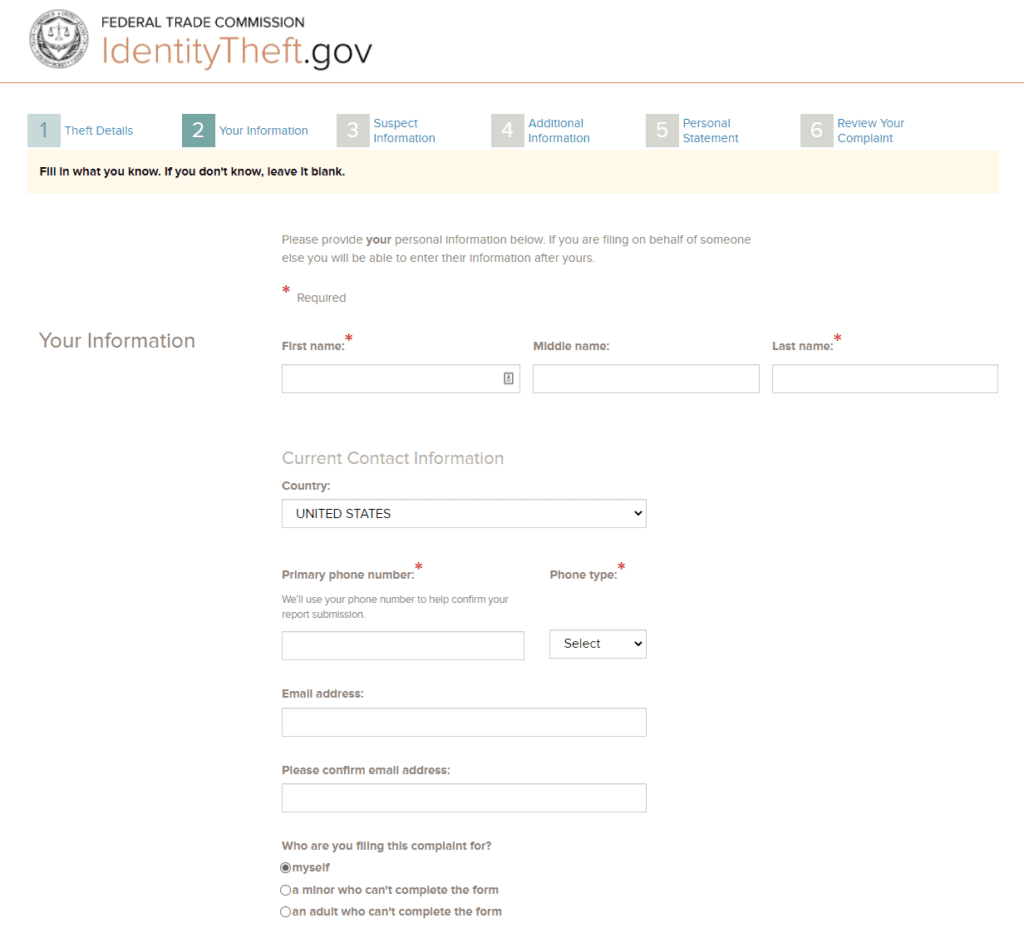

After you enter all the account information, you will need to provide the FTC will all your details, including name, address, birthday.

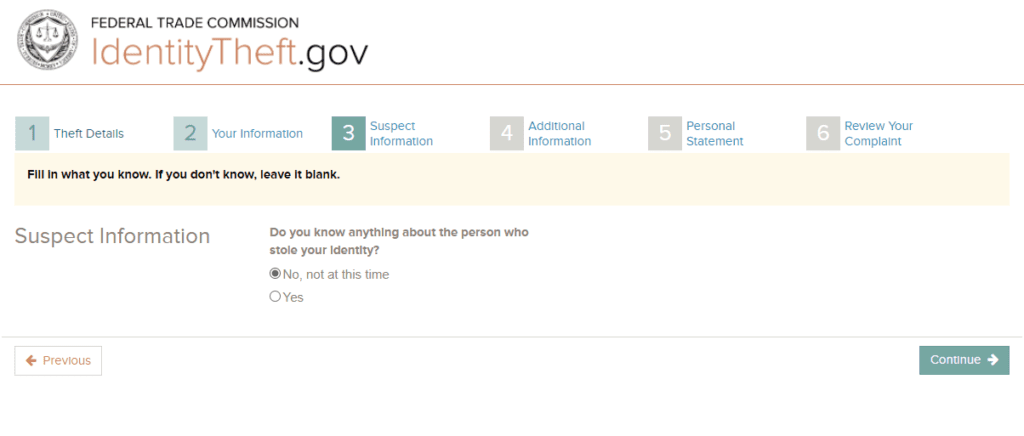

After entering in your information, it will ask you if you have any information or awareness of who stole your identity. You will want to be as honest as possible here.

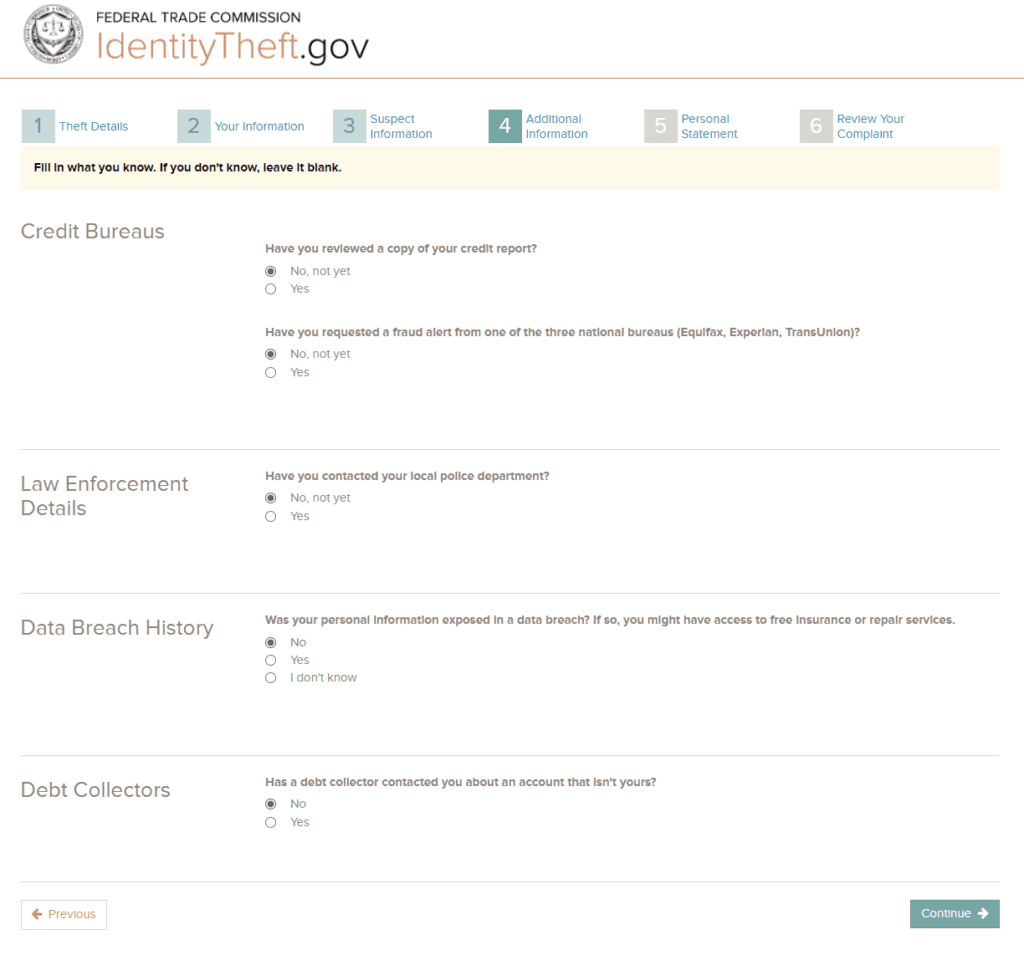

Select the options that are most relevant here. Some of which may have already occurred, but if you caught it early enough you may not have collections accounts related to this yet.

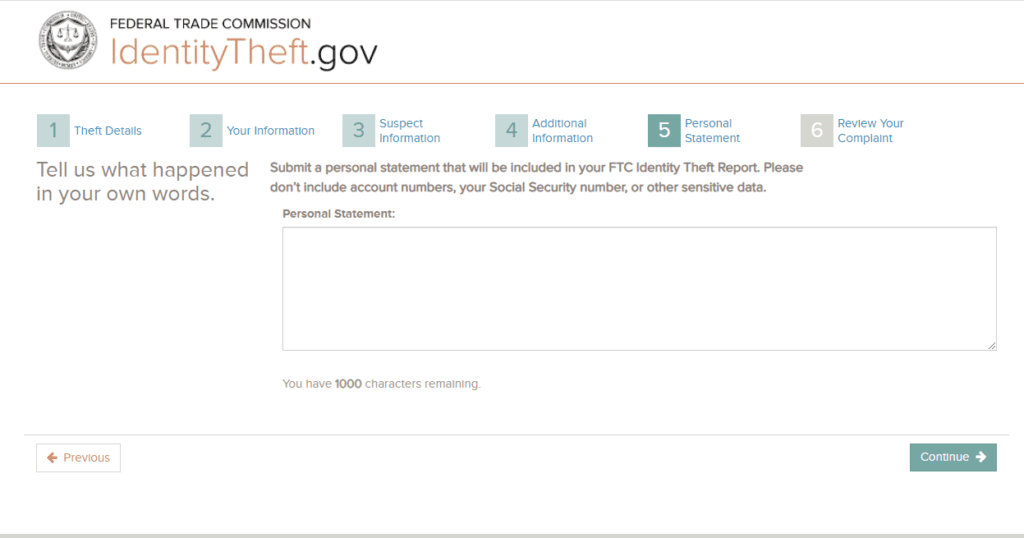

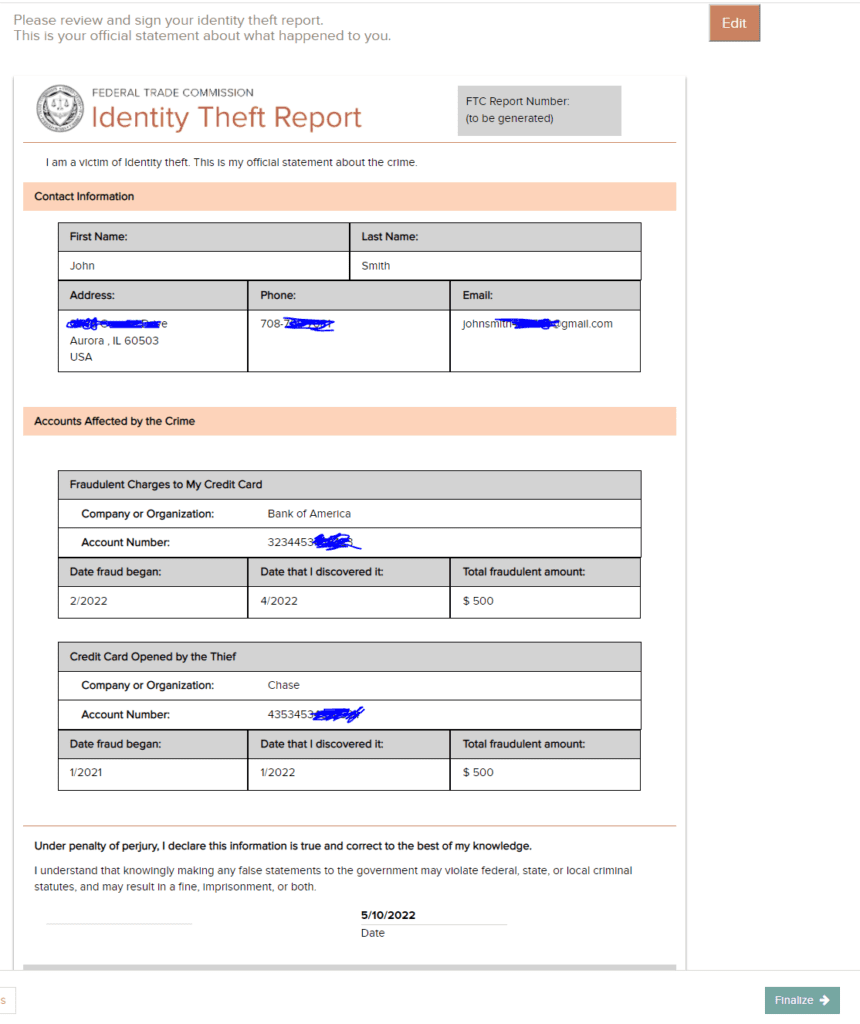

The final step is to provide a personal statement. You will want to state everything you know factually about what happened, in your own words. Be concise but don’t fabricate. Remember this is a legally binding document, and you are subject to perjury statutes if you lie anywhere on this form.

At this stage you will need to sign off on the document. What you are looking at on this page will be your report, and will be provided to you in PDF format so you can use the report with all the various accounts and entities you need to work with.

How To Handle With The Credit Bureaus

Once you have your ID theft report in hand, the credit bureaus will be obligated to block any information that is on your credit report that is related to the crime. Notice I didn’t say remove. The information will still be in the file but will not show on any report, and therefor will not be included in any credit scoring. For all intents and purposes it will be removed for your report.

It is important to do this by mail, as they will need a physical copy of your ID theft report. There are ways to do this over the phone, email and electronic, but the FTC recommends doing this by mail. I take it a step further and recommend you do so Certified Mail Return Receipt.

Contact the Three Credit Bureaus

Write a letter that can be addressed to all three for the credit bureaus. You will need to send one to each. The FTC website has a great sample letter to use. Remember to include a copy of your FTC Identity Theft Report and proof of your identity, like your name, address, and Social Security number. Generally, the process moves faster if you include a photocopy of your drivers license. Ask them to block all information related to the theft.

TransUnion:

Fraud Victim Assistance Department

P.O. Box 2000

Chester, PA 19016

1-800-680-7289

Equifax:

P.O. Box 105069

Atlanta, GA 30348-5069

1-800-525-6285

Experian:

P.O. Box 9554

Allen, TX 75013

1-888-397-3742

At this stage, you may want to consider an extended fraud alert, but know these can be difficult to remove and shouldn’t be added if you are going to be looking into purchasing a home in the next year. I personally recommend monitoring your credit, either with credit report pulls or a third party monitoring software. There are many free options available these days, whether included with a credit account or a service like Credit Karma.

What if New Accounts are Opened in Your Name?

As you have completed FTC Identity Theft Report process, simple contact the fraud department of each business where an account was opened.

- Explain that someone stole your identity and opened this account.

- Ask the business to close the account immediately.

- Request the business send you a document that proves the account was requested to be closed, that it does not belong to you and you are not responsible for any of the debt related

- Keep the letter. If this account shows up on your credit report, you can use this in conjunction with the FTC Identity Theft report to demand blocking of the account. This shouldn’t occur because you contacted the credit bureaus in advance, but it has happened plenty

Bogus or Invalid Charges:

These are handled in the same as new accounts. Make sure to keep the letter they provided as proof in the event you need to file a dispute with the credit bureaus.

How to Stop Debt Collectors and Collection Companies

As with all collection debt, the laws work in your favor if you reach out within 30 days of receiving your dunning notification.

- Advise the collection company you are a victim of identity theft, and the debt is not yours.

- Provide the FTC Identity Theft report to the collection company.

Next, reach out to the business the debt belongs to, if you have not done so in the above steps.

- Advise the collection company you are a victim of identity theft, and the debt is not yours.

- Tell them to stop reporting this debt to the credit bureaus if is reporting, and demand it not be reported if it is not.

- Request information relating to how this debt was accrued, so you can use this in the event it reports on your credit report.

This will not work in all situations. If there is a company who is being especially egregious, make sure you take a look at our Ultimate Guide to Credit Repair.

Reporting a Stolen Social Security Number

On the FTC Identity Theft report, there was an area to select what you felt was compromise. If you have confirmed your social security number has been stolen, there are a couple additional steps you should take.

Social Security card lost or stolen? Apply online to get a replacement card.

Has someone else used your Social Security number for employment? You can check your Social Security work history by creating an account at socialsecurity.gov/myaccount. If you noticed any issues, contact your local SSA office.

What if Your Identity is Used in a Crime?

This next content was taken directly from the IdentityTheft.Gov website.

If someone is arrested and uses your name or personal information, contact the law enforcement agency that arrested the thief. You may need to check court records to find out where the thief was arrested.

IdentityTheft.gov

If a court prosecutes an identity thief using your name, contact the court where the arrest or conviction happened.

IdentityTheft.Gov

Each entity will have their own steps you will need take in order to clear your name. You should considering hiring a lawyer to help you in the next phase of the restoration.

This article was last updated on May 11, 2022