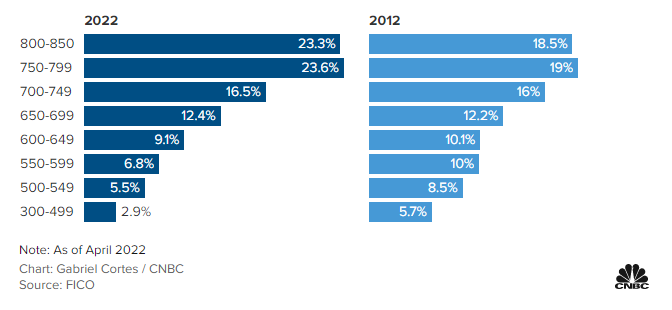

Credit scores have steadily increased in the last 10 years, with the average consumers FICO credit score hitting an all time high of 716. Low credit scores (those with scores under 600) have in turn hit an all time low, at 15% of all consumers. Will this trend continue in the years to come?

What Low Credit Scores Have Traditionally Meant for Consumers

If you are on this website, you either have a low credit score now, or had one in the past and understand the ramifications of a low median score. Consumers with low credit scores on average will spent 20% more over the course of their loan, if they are able to get a loan. While the improvement year over year is a nice trend to see, the impact has been blunted when it comes to certain consumers.

Minority Borrowers Impacted More by a Low Credit Score

Younger Americans in primarily Black and Hispanic communities have lower credit scores than their white counterparts, according to a separate Urban Institute analysis based on Vantage scores. While Vantage scores are not the same as FICO, the overall trend line can be extrapolated to FICO. Minority Americans are also more likely to see low credit scores over time, with less improvement.

From 2010 to 2021, about one-third of 18 to 29year-olds in primarily Black communities and more than one-quarter in majority-Hispanic communities saw credit scores decreases, compared with just 21% of those in primarily white communities.

Between ages 25 and 29, young adults in primarily Black communities have a median credit score of 582, just barely above the range considered poor, compared with those in primarily Hispanic communities, who have a median score of 644, and those in majority-white communities, who have a median score of 687.

“Without dedicated interventions, credit disparities among young people will likely grow, causing the racial wealth gap to widen. A comprehensive suite of policies that addresses the root causes of racial and ethnic disparities is needed to ensure every young person in America has an opportunity for a bright future.” the Urban Institute said.

Steps to Improve You Low Credit Score:

There are many steps you can take to improve your credit score, starting off with credit repair. However, credit repair is not your only option to raising your credit score. As shown in the video below, AZEO (All Zero Except One) is a great approach to improving your credit score.

Here are some additional resources to improving your credit score.

- Ultimate Guide to Credit Repair

- Easy Credit Score Hacks for 2022

- The AZEO Method: Still Relevant in 2022

- Why are Credit Scores Hard to Understand?

- Five Steps to Better Credit and a Better Credit Score

- The Biggest Credit Score Myth in 2021

This article was last updated on August 30, 2022