The housing market is booming! Those who have seen their finances stabilize during the past year are reaping the rewards. Don’t miss out. Being buyer ready during COVID is the best way to find the home of your dreams, at the lowest interest rates ever! Are you ready?

Key Points:

- Being buyer ready during COVID requires up front planning.

- Know your credit ahead of time.

- Prepare all documents and keep them current.

- The housing market is turning over fast. Be ready for the action!

Prepare by Organizing:

The very first step is decide where your home buying documentation is going to live. Pick a cloud service provider or purchase a thumb drive. The reason to decide this ahead of time is simple. You need to move fast, so having everything in once place from the get go is key. I recommend creating folders called Bank Statements, Credit Reports, and Personal.

Have Your Credit Buyer Ready During COVID

The average consumers credit score has been 686 during 2020. This is only down slightly from 2019. If you have not suffered the effects of the pandemic (at least financially) now is the time to pull your reports and start to analyze what is on there. Annual Credit Report is offering free reports weekly, so it is easy to obtain your Transunion, Equifax, and Experian credit report for free.

Take notice of the following:

- Take note of any negative item that is appearing. Are these items older than a year? Are they paid or unpaid?

- How do your inquiries look in the last year?

- How many accounts are showing balance?

First and foremost, work to get your credit card accounts showing a zero dollar balance, with the exception of one. If possible, have this card showing less than 7 percent utilization. This will address two concerns. Having only one card showing a low balance will maximize your FICO score, and doing so will also lower the total payments monthly for your debt to income ratio when applying for a mortgage.

Address any unpaid collections or judgements. Ideally, you will want to pay for delete if at all possible. Most lenders dealing with conventional will want to see this as clean as possible, with an exception to medical collections under $1000. If you are looking to qualify for FHA, you can be a little more flexible with this. Remember, the FICO buckets are pretty forgiving of a couple older, negative items if you are able to keep your other FICO criteria manageable.

To Pay or Not To Pay:

If possible, pay you revolving debts but do not dispute negative items. Showing a negative item in dispute is a sure fire way to have underwriting reject your mortgage application. If you have late payments on any account within the last year, work to remove those using a goodwill adjustment. Most lenders will not lend to a buyer showing recent late payments.

After all the pay downs are reflected in your statements (generally takes a month to 45 days), pull your free reports again. If everything is looking how you’d like, it is time to pull your credit scores.

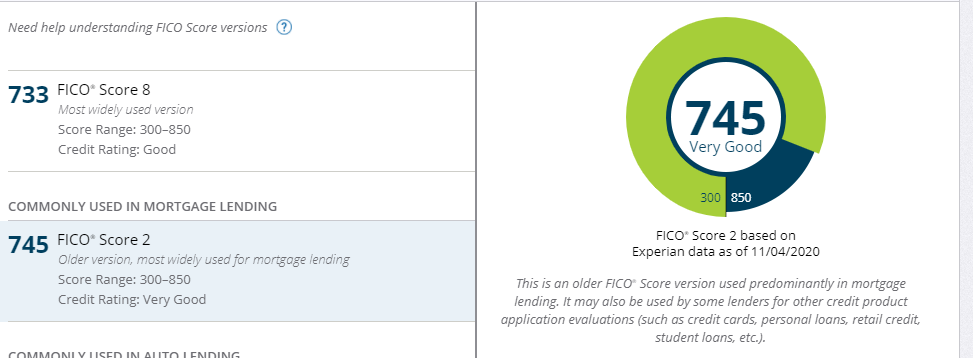

When preparing to buy a home, you need to know your actual FICO mortgage lender scores. Thankfully, myFico will sell those to you. Knowing these scores are crucial, as you can learn what your likely interest rate will be ahead of time. FICO offers many different scores, relying on your FICO 8 from credit cards is not ideal.

Remember, in order to qualify for traditional lending, your mid credit score needs to be at least 680. During COVID, lenders have really tightened their requirements. If you are qualifying for FHA, getting your score to 640 will be helpful, but not required.

Prepare Financial and Employment Documents:

One sure fire way to save a ton of time ahead of pre-approval is to have all your bank statements, tax documents, and investment documents ready and updated. I recommend pulling these every week or month, depending on how often the statements come on. Any loan officer will ask for these before writing the preapproval letter.

While having all financial documents will be required for closing, you likely won’t need every last investment document or 401k document simply to pre-approve. However, your lender may ask for your most recent W2 or tax return for proof of employment so have these at the ready.

If you are married or have multiple accounts, make sure you have statements prepared for all standard bank accounts.

Lastly, if you are working remotely during COVID, your lender may require a letter saying you are able to work remotely. This especially matters if you are relocating to a new area but keeping your current employment.

Don’t Forget:

- Know how much home you can afford by working with your loan officer and real estate professional.

- Have your team in the loop ahead of any discussions. Decide on a realtor and a loan officer before starting your home search.

- Properties are moving in as little as one day. The more prepared you are upfront, the easier the experience will be.

With planning and organization, you will be buyer ready during COVID and in the best position to move fast to land the home of your dreams!

This article was last updated on May 9, 2022